There’s a famous quote in the investing world that “this time things are different.” This quote is used over and over again to discuss new technologies, economics, or investment opportunities. But the more we see the world change, the more it almost looks the same. Let’s start with a recap of 2020

2020 was on for the record books. If you read any of my prior posts, you probably saw this chart but it’s amazing to see how fast the stock market recovered from the COVID-19 correction.

Tech Stocks exploded higher

Work-from-home stocks exploded higher

Bitcoin exploded higher

Fast forward to today and this has even further been exacerbated, especially with Bitcoin. After fantastic investment returns across varying asset classes, investors begin to flock to new, riskier investments. The returns are attractive, the FOMO is real, and portfolios being slowly gravitating towards these riskier assets.

So, what does this have to do with history? Let’s go back to 1985.

Diamonds Are Forever

A few months back, I was cleaning out files from an advisor who recently retired. In his files, were Barron’s articles from the 1980s. The paper was quite a great reminder of how far the world has come. From articles on commercial flights to discussing the first computers, it really took me back.

But one thing was more prevalent than others…diamonds.

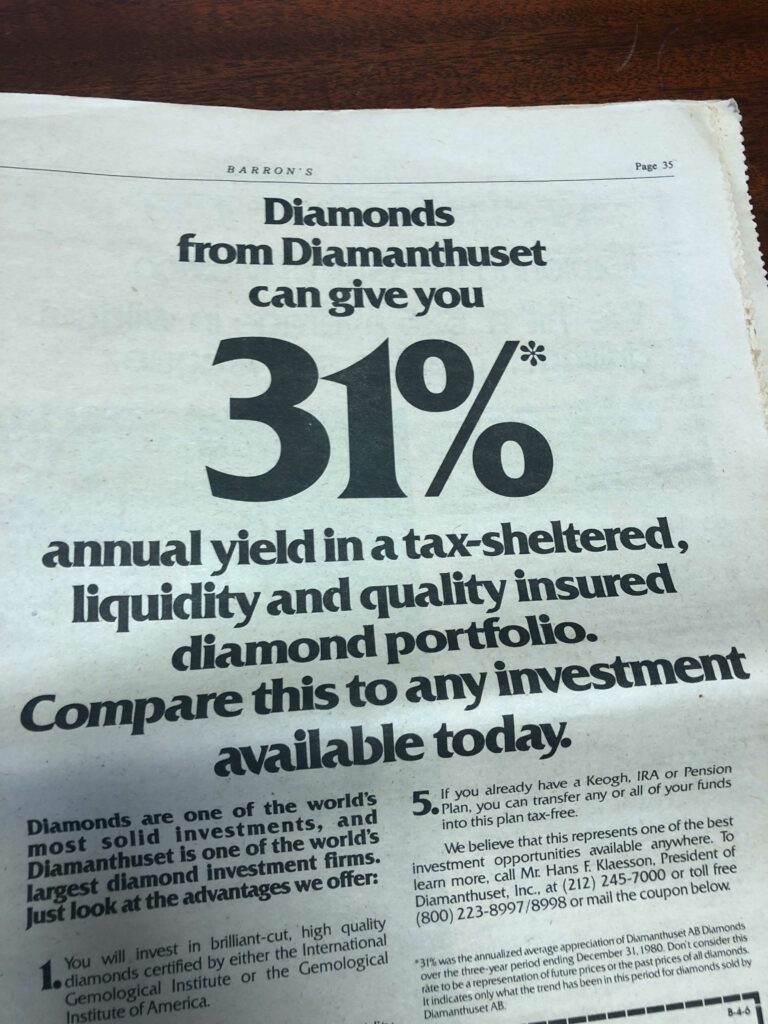

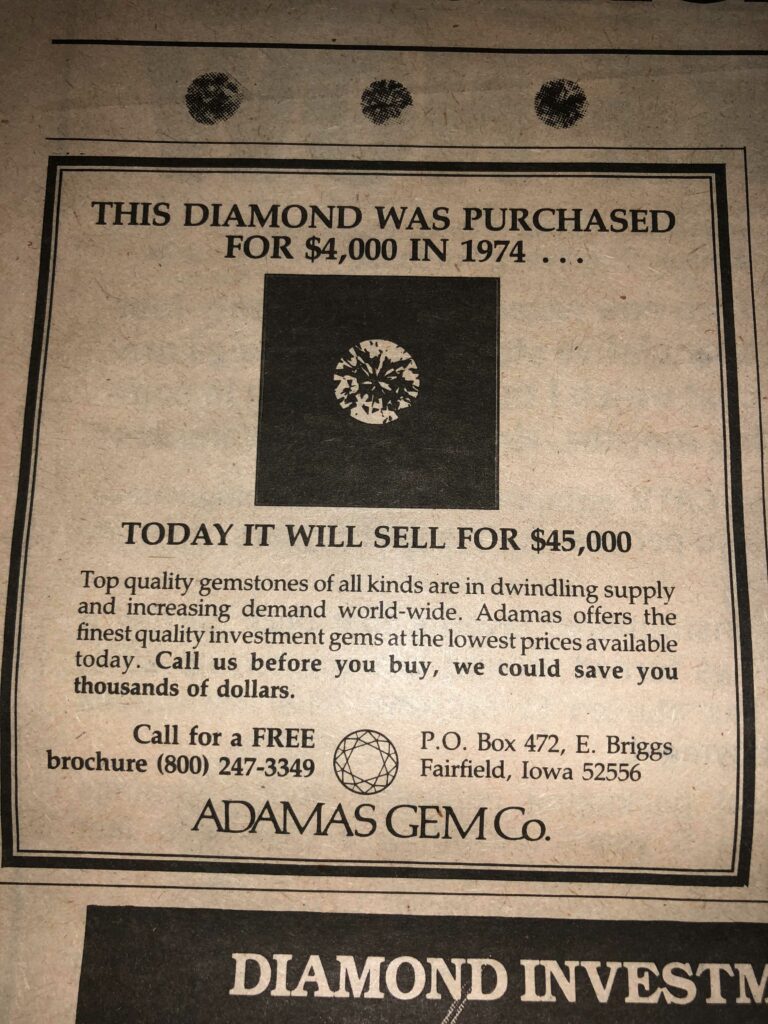

Almost every page in this 30+ page newspaper has some corner talking about the investment possibilities of diamonds. Here are a few quotes to highlight:

“Diamonds are one of the world’s most solid investments”

“Best investment opportunities available anywhere”

“31% annual yield, tax-sheltered, liquid”

Why would you not want to invest in diamonds?

As I kept flipping through the pages, it was more and more prevalent. Small diamond articles, full-page articles, subliminal messages with diamond images but no verbiage. To me, it seemed like the FOMO from the 1980s. Inflation was sky-high, you need to protect your money, it’s time to buy diamonds! But, how did that work out?

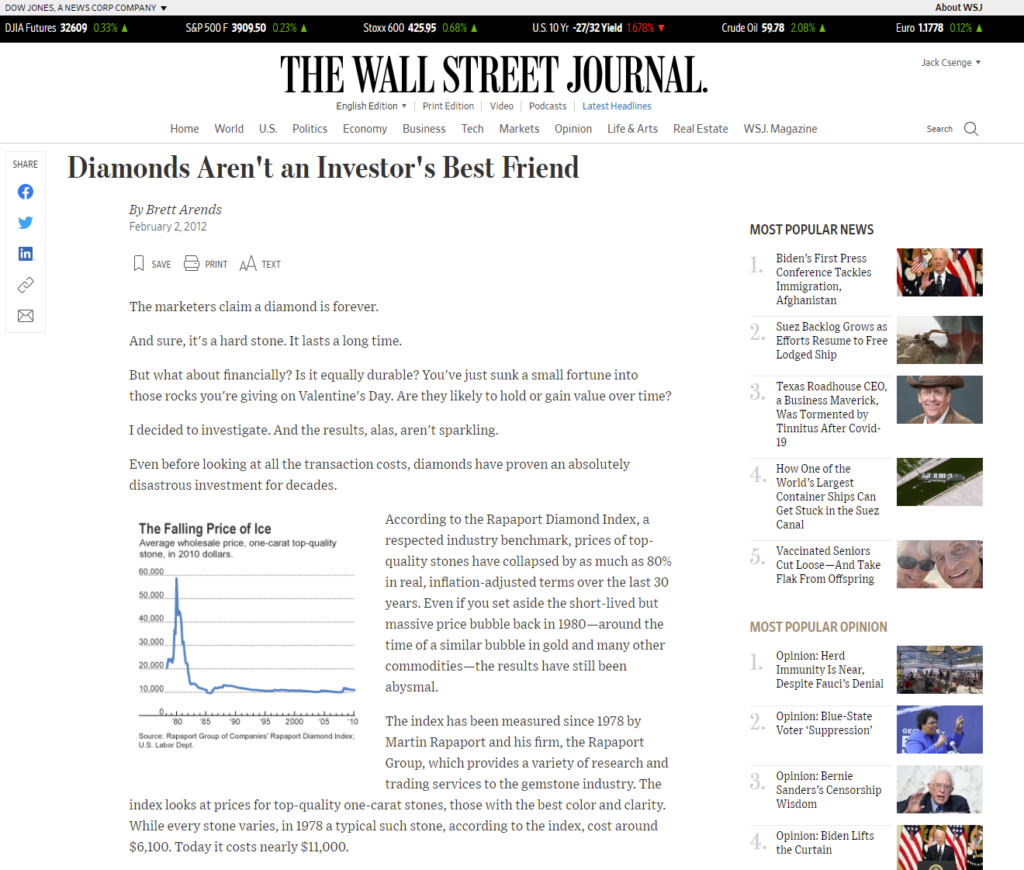

In 2012, The Wall Street Journal ran an article on Diamonds Aren’t an Investor’s Best Friend. The conclusion here was that diamonds were more of a marketing scheme and in the long-run only kept up with inflation over-time.

The Diamonds of the 2020s

As I write this today, I almost think the entire Cryptocurrency market is following a similar trajectory. Sure, the technology has promising applications but the investment angle is becoming excessive.

The FOMO is at all-time highs, prices are at all-time highs, and the advertisements seem to keep on rolling. Literally, as I was uploading the photos from Barron’s article, this advertisement came across my Twitter feed.

How all of this pans out in the long-run is anyone guess. Maybe Cryptocurrencies become a major asset class, and if that holds true, your portfolios with naturally grow to include it. But, it’s also just as possible that diamonds come back into fashion and those take a meaningful place in your portfolio. Both sound plausible yet at the same time completely asinine.

There is more “stuff” than ever to invest in during today’s markets and investors need to seriously caution themselves as to whether or not they should participate. From apps to buy sneakers to apps to buy paintings, you can just about invest in anything. But, the real question is, should you?

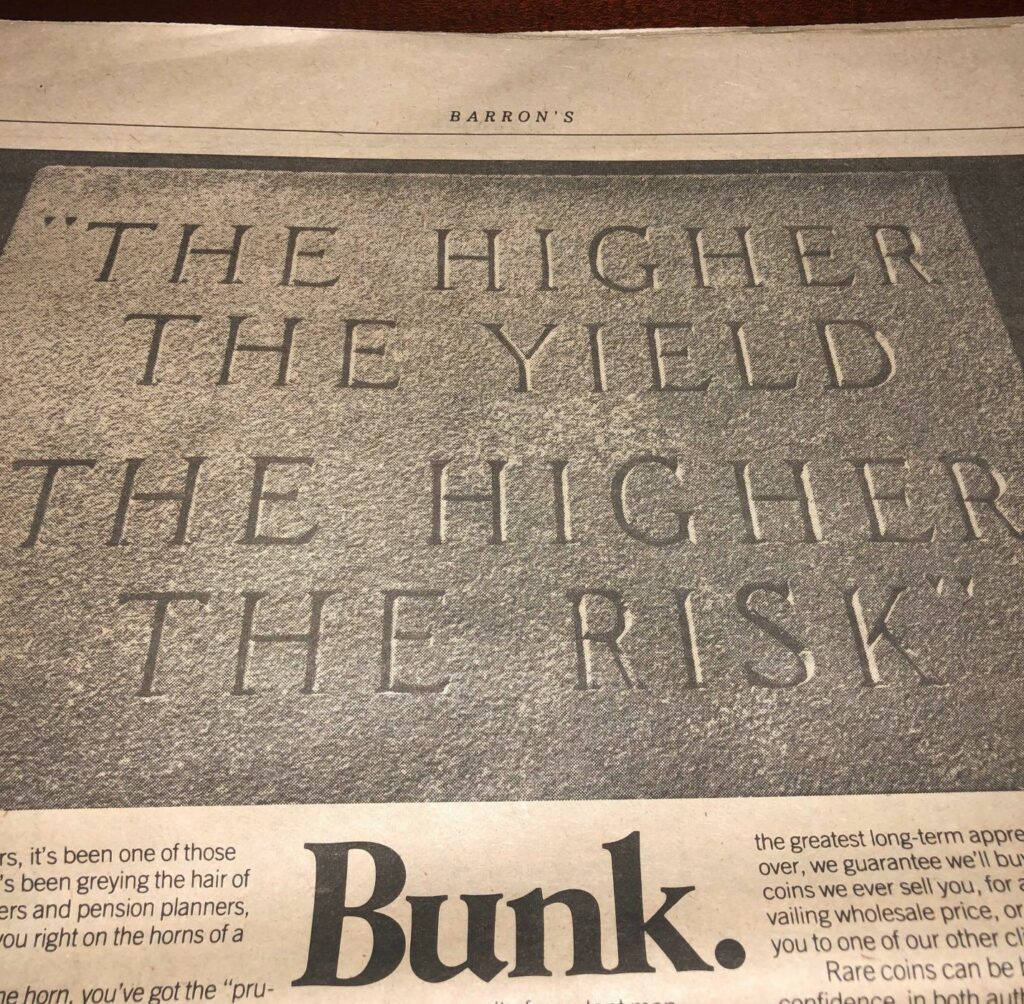

Among the entire 1980s article of diamond recommendations, one piece stood out. One, smart columnist, decided to put a cautionary tail into the article. These are words all investors need to remember because it has always held true. The higher the yield, the higher the risk! Understanding the risk you are taking is one of the most important concepts in investing.

To get my entire opinion on Cryptocurrencies, you can read more here: My View on Bitcoin

Disclosure:

Csenge Advisory Group, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, asset class, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

This article should not be considered an endorsement of any platforms, websites, or products discussed. All information provided is the opinion of the author and does not directly represent the views of Csenge Advisory Group.