Customized Asset Management Designed to Preserve Wealth.

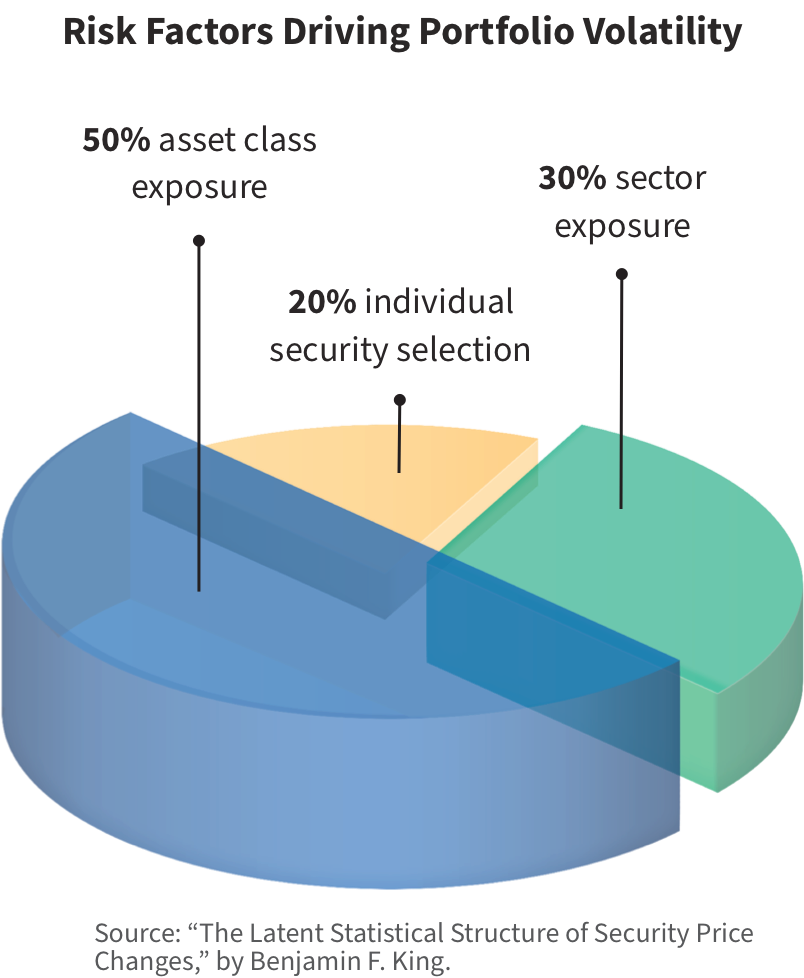

Studies show approximately 80% of portfolio returns are derived from asset class and sector selection, while only 20% of returns come from individual product selection. At Csenge, we are mindful of this 100% of the time. The more we analyze asset classes and subsectors, the more optimal risk-adjusted returns can be generated for your portfolio.