Despite the positive long-term trends, volatility across your investment portfolio is more common than you may realize. As uncomfortable as they are, declines of 10% or greater occur almost every year. Below you will see a chart showing the largest intra-year decline compared to the closing return for the stock market. What’s evident over time is that volatility throughout the year has little impact on how the year might actually turn out.

Looking Ahead

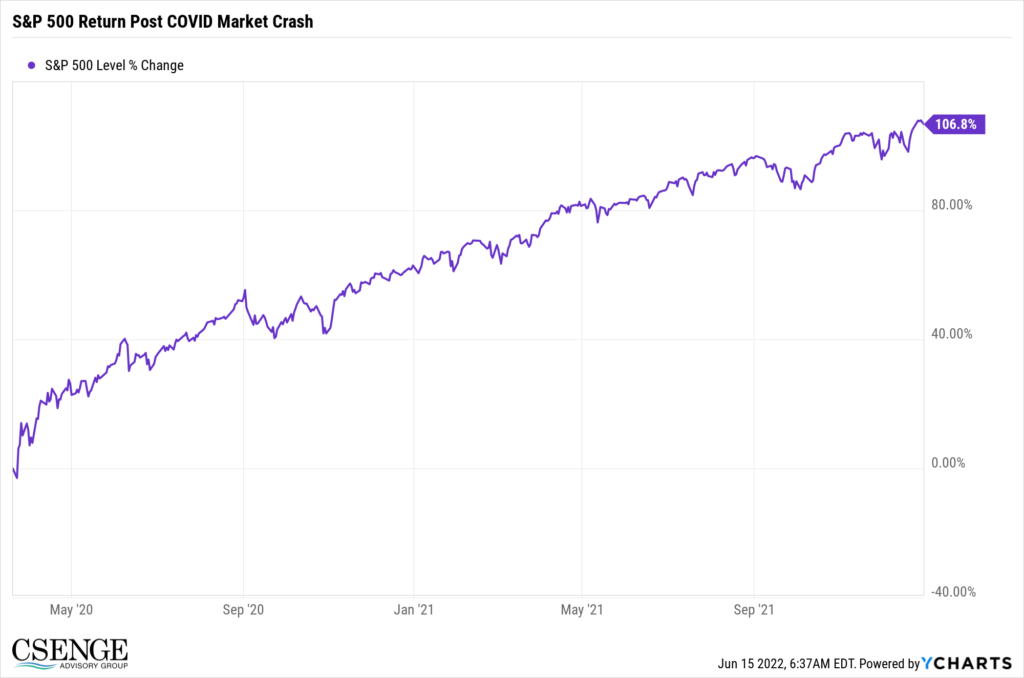

The stock market is a forward-looking indicator of where the economy is going. If you think back to the market correction of 2020, the market bottomed in March around the impact of COVID. While most investors were focused on health concerns with COVID, the stock market was already looking ahead at fiscal stimulus, stock valuations, and a new economy. In fact, from the low point in the market in March of 2020, the market proceeded higher by over 100% over the following 18 months!

Staying Focused

While today’s market environment may seem stressful, it is just one of many events that will occur throughout your financial journey. Sure, higher inflation and interest rates are concerning but it’s just another part of the world you have no control over. Staying disciplined with your financial plans and investment strategies is the best remedy for markets like this. There are things you have control over and things out of your control. Focusing on the controllable aspects of your financial picture is the best path forward.

So, what now? If you’re looking for a solution for the current market environment, I’d highly recommend looking at your monthly cash flow. If your monthly budget is balanced and you are not piling up debt, you are in the best position to not need to sell your investments in a weak market.

The market will recover in time and volatility will eventually subside. New highs will come whether weeks, months, or quarters from now. The decisions we make today will impact our financial future for decades to come.

Stay the course!