There is an all too common theme we hear from investors almost every year. Some investment idea draws investors together with the hopes of outsized returns. In some years it’s technology, in others it’s international investing. But the same theme is true each year, investors chase returns.

Diversification

Almost every month during some client review, a topic comes up around “why do we own XYZ security”. Typically, it’s something like gold or silver, or some hedge of an investment geared to protect investors from market volatility. Investors do not enjoy seeing investments remain flat or underperform another portfolio holding. But the truth is, not everything goes up in lockstep. Some investments will do well, while others underperform.

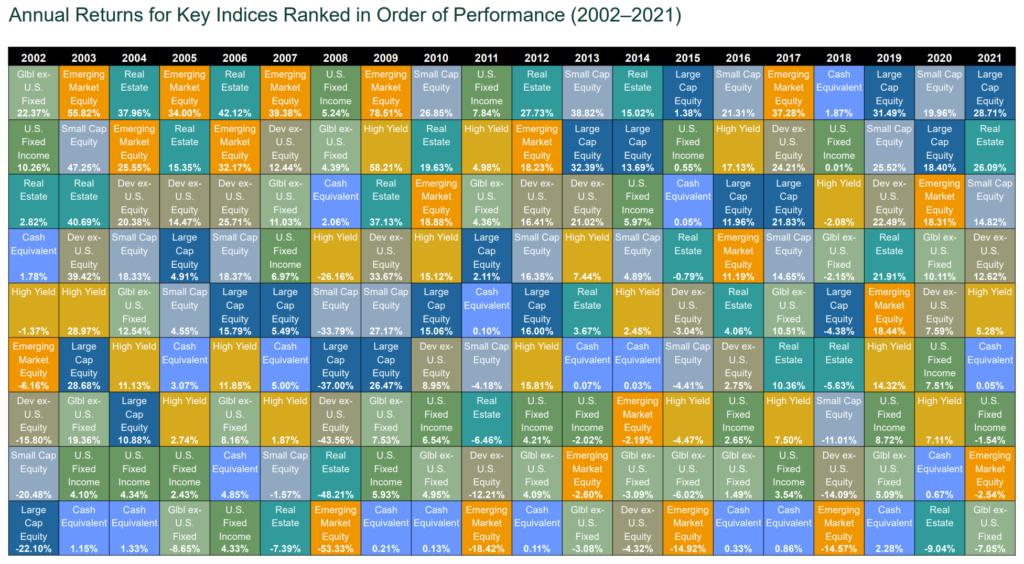

Take a look at the chart below by Callan. I love this chart and use it with investors in almost every meeting. Reading each square is not necessary but instead, focus on the color of the box. Each box represents a different type of investment a client could be invested in. The top column shows the year and the investments are then ranked from best to worst-performing.

- Dark Blue = Large US Stocks

- Orange = Emerging Market Stocks

- Green = Us Fixed Income

These are just a few of the categories but the key point of this chart is no two years are really the same. Each year, some investment category outperforms the rest of its peers. Sure, some years there are recurring themes but over long periods of time, it’s almost random what will perform best and what will perform worst.

Emerging Market Stocks were a hit in the early 2000s and today nobody seems to want to own them.

Diversification in 2022

The start of 2022 has been a huge indicator of why we need to diversify our holdings. All last year, we saw massive gains across technology and real estate investments. Almost every investor has seen substantial gains in their property values and technology stocks and has continued to double down on those themes.

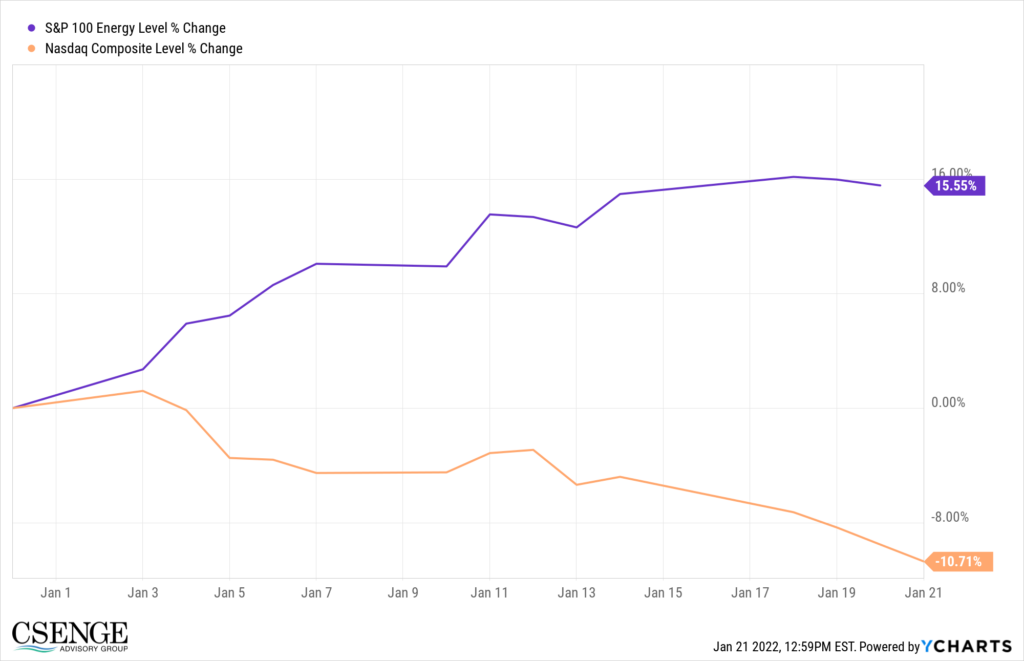

So this is where diversification comes in. I will write another post soon on inflation but right now the cost of living has skyrocketed. Between COVID lockdowns across the country, limited employment in various sectors, and transportation and shipping operations not at full capacity, we are seeing energy and commodity prices soar while technology companies are beginning to crash.

A well-diversified portfolio would be minimally impacted here but a concentrated portfolio in technology stocks would really be feeling some pain.

How We Manage Money

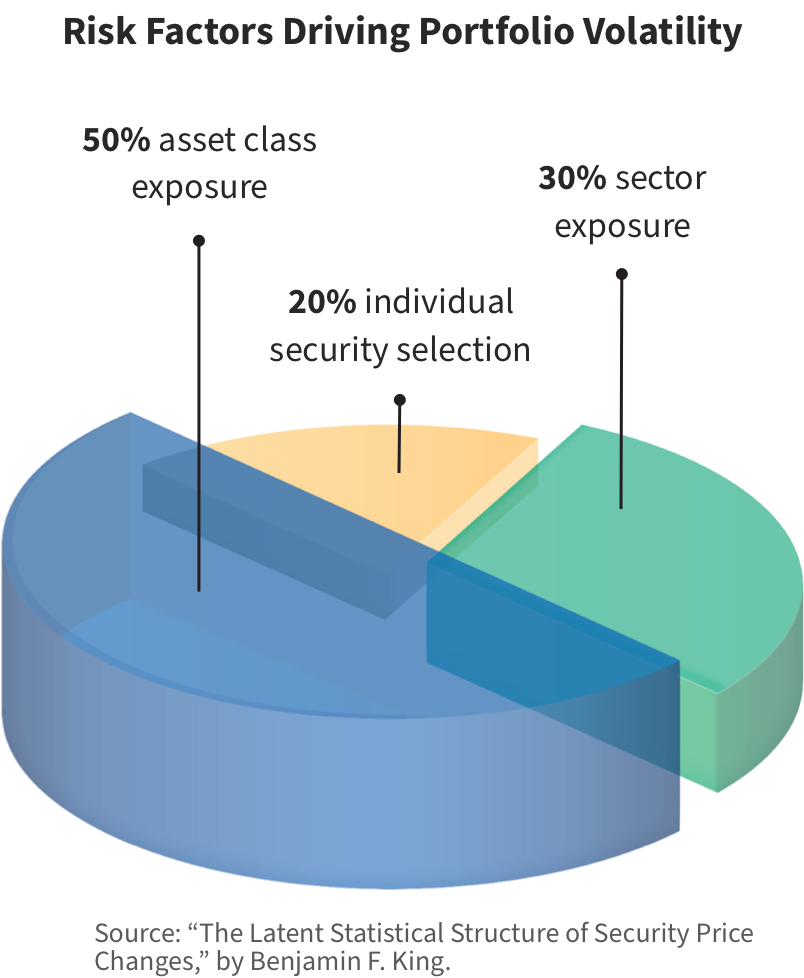

This is where I want to highlight how our firm helps keep investors stay in their seats. The CAG Asset Management process is designed to preserve wealth. Massive portfolio gains are great but if you are not able to realize those gains it’s irrelevant. Our focus is to have investors playing offense at certain points of the year and defense at others. The same is true in sectors of the economy and on the individual stock level.

To quote Eric Caisse, our Chief Investment Officer:

Our mission is to participate when the markets are supportive of higher prices and hedge when market risks are elevated, allowing us to optimize your portfolio’s ability to best meet your goals.

This is where diversification comes into play. Part of investing your money is understanding how you react in various market cycles. If you are losing your mind now and are fully invested in technology stocks, that’s a great indication you should tone down your risk and diversify your holdings.

If you are comfortable with the fluctuations in your portfolio given the recent volatility in the market, then you are most likely appropriately diversified.

The goal at the end of the day is not to get rich quickly but rather stay wealthy.

Disclosure:

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, asset class, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

This article should not be considered an endorsement of any platforms, websites, or products discussed. All information provided is the opinion of the author and does not directly represent the views of Csenge Advisory Group.