Flavor Flav was right…the hype mans’ job is to get everyone excited, engaging, and participating in the action.

But when it comes to your investments, is this what you should really be doing?

This past week we saw something remarkable. For the first time, a massive group of individual investors rallied together and decided to attack Wall Street titans from every angle.

This wasn’t a bunch of people with a solid investing thesis on businesses like Gamestop, AMC Theaters, and Blackberry but rather some brilliant research into how markets work followed by a lot of hype.

If you need to get caught up on what happened, Gamestop has had numerous hedge funds betting on its demise for years. This bet against a company is called a “short”, where investors bet a company will fall to almost $0.

Why might someone bet against a company you might ask? Let’s quickly check the health of Gamestop as a business.

Gamestop has been fighting against a megatrend of digitization for years. Since 2011, the firm has continued to deteriorate and lose revenue. The chart above shows the total trailing revenue of Gamestop going back to 2011. Based on the figures in early 2020, COVID alone almost put this company out of its misery.

So this is where investors might “short” a business. Investors might bet these trends will continue and eventually the business will close up. A short bet lets them profit off falling stocks.

However, a few brilliant individuals figured out if they could get the share price of Gamestop stock to a certain price, a flurry of actions would have to be taken exploding the share price higher.

Every bet has a counter bet and with a little ingenuity, a few investors spotted a hedge fund with a hole in their “short” bet. Counter-bets were taken, then the marketing machine went nuts.

What happened next, after some of the first investors took bets on Gamestop stock, was wild. Some brilliant individuals at the start of this Gamestop trade made a killing…but then the rest of the world got involved.

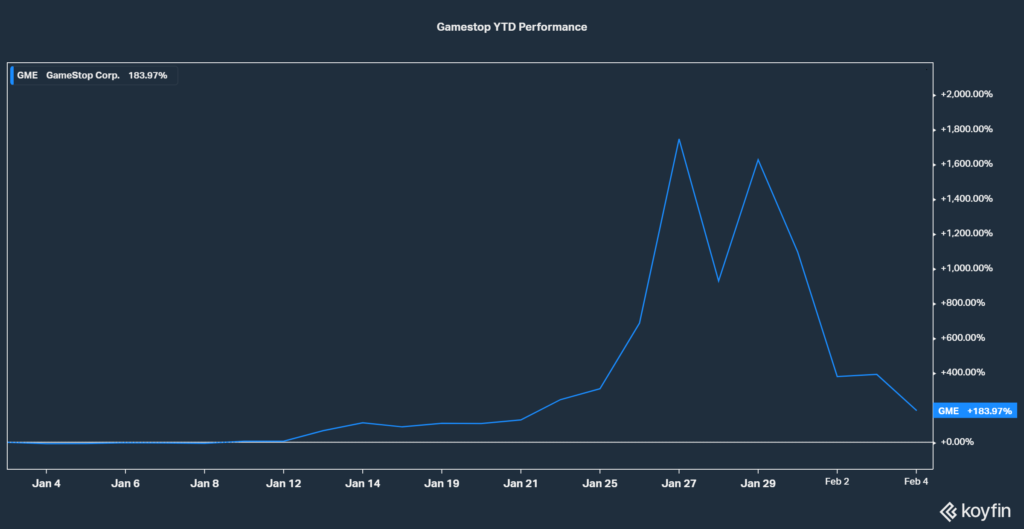

The price of Gamestop stock soared almost 1800%, a hedge fund almost got put out of business, and a few brokerage firms halted trading in the stock.

The news media begins to cheer for the “little guys” taking on the man. Stories flood social media with parents who bought their kids Gamestop stock. Even my cellphone was blowing up with clients, family, and friends all asking “should we buy some Gamestop stock?!

The news coverage was so intense it was almost impossible to know if you should buy or sell Gamestop stock.

Misinformation is ruthless.

You really have to understand what you are doing before you jump in. If you enjoy Hype Investing, you might as well be hanging out at a Vegas casino.

Investing in Gamestop is not investing, it’s gambling. If you understand that at the start, you are ahead of most. But unfortunately, the fall out from Gamestop won’t be recognized for a while. How many individual investors followed the hype at $200/sh, or $300/sh, and are now crushed with the stock trading around $50/sh.

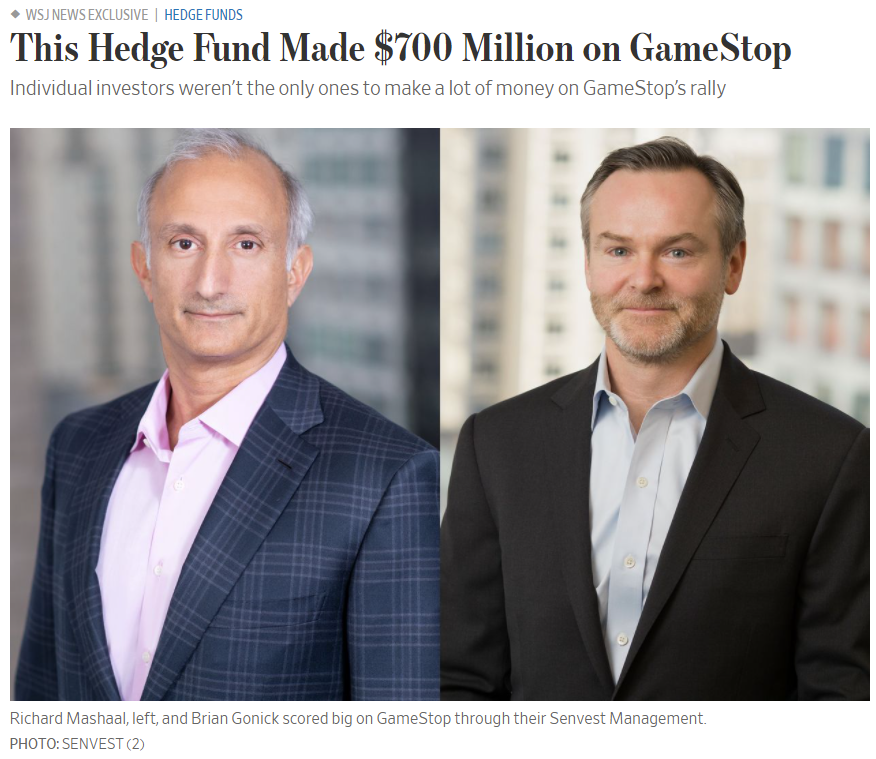

Yes, everyone was excited to hear about a few kids making millions of dollars “fighting back at the man” but was that really was happened? In my eyes, this was a major marketing event that lured poor investors into the traps of Wall Street. While most people are focused on a few rich kids, they forget that there are millions of professional investors that do this for a living. Maybe Keith Gill made $10,000,000 trading Gamestop but who really won. How many confused individuals lost on this trade?

The machine that is the stock market is complex. You never know who you are buying from and who you are selling to. It’s a black box of trades flying all over the place. Investors need to focus on what they are doing with their money before they take part. Create some principles for what you will invest in, then search for opportunities.

A good rule I always follow is don’t buy terrible businesses. I don’t know a single person that is adamant about investing in companies on the verge of bankruptcy. So ask yourself, does Gamestop really seem like a promising growth opportunity for the years ahead? Or, is it instead, one of the dozens of retailers headed for extinction?

Disclosure:

Csenge Advisory Group, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, asset class, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.