Over the past few weeks, I have been diving into Atomic Habits by James Clear. The book is a wonderful exploration of how our brains create both good and bad habits. If you ever read the book “The Power of Habit by Charles Duhigg”, this is a great follow-up and expansion on that same idea.

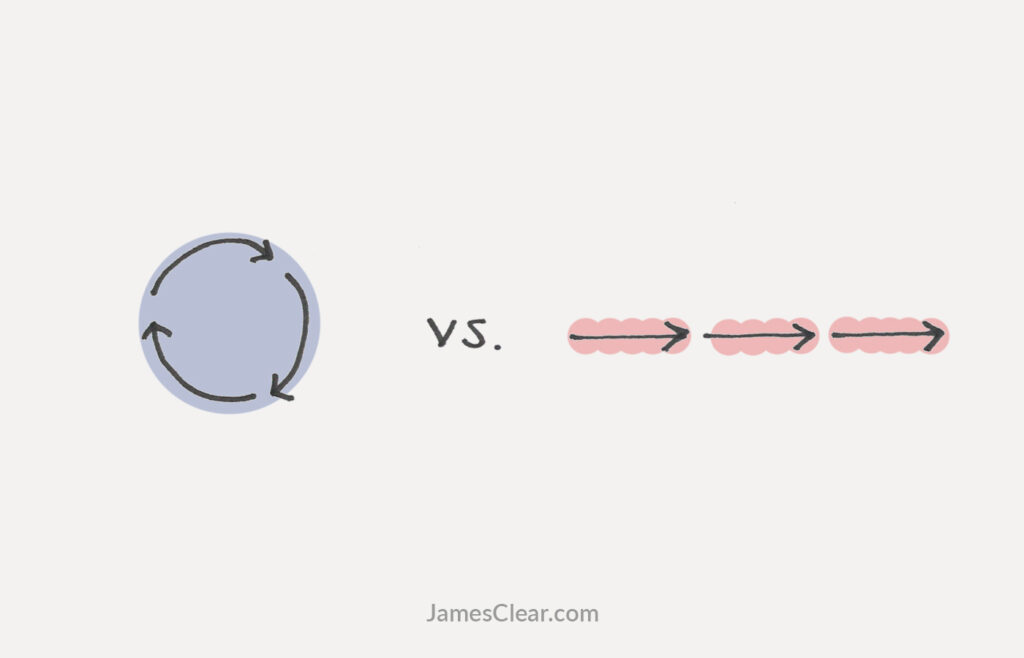

One of the topics in James’ book discussed the idea of “Motion vs. Action”. The thinking here is relatively simple, let’s use the case of wanting to eat better.

| Motion | the organization and prep work leading up to the start of an action. Think of this as researching diet plans online. |

| Action | the behavior that will deliver the outcoming for a goal. Think of this as actually cooking meals for the week |

Both Motion and Action mentally put us into the focus of improving our eating, but only one of them actually helps us show progress…Action

Motion has us spinning our wheels and begins to turn the gears but only Action moves us forward.

As I speak with clients on a regular basis, often I find them stuck in the Motion stage. Almost ever investor we meet with has the best intentions for their financial future, yet most are stuck on the treadmill that is Motion.

They research retirement accounts.

They research the stock market.

The research setting up a Will or Power of Attorney.

They research insurance.

But rarely, do they ever execute these plans.

At the end of the day, we need some inertia to get started with these financial goals and allow them to take root. Especially, in the case of estate planning documents. Most people will only find the Action needed to begin drafting up a Will once some serious health issues pop into their lives.

So, what are some best practices to convert yourself from Motion to Action with your personal finances?

Savings

My first recommendation is to start with your savings account. If you want to take Action with your savings, sign in to your bank account and set up a recurring contribution. My preference is to have your savings account at a completely different institution. This way you take the necessary Action to put money aside but put a few steps in front of you to undo it.

Retirement

To improve the Action you take with your retirement, consider enrolling in the automatic increase program with your 401k. Most companies will increase your contributions automatically each year. It’s a simple setting that needs to be toggled on and the Action is all out of sight, out of mind.

Debt

If you need to take more Action around managing debt, start by making some phone calls. If you have significant credit card or medical bills, a lot of online lenders will help consolidate those into a more manageable payment plan.

Also, if you are the type of person who keeps spending out of control, try cutting up a card. It’s quite amazing how quickly the Action of cutting your credit card will stop excess debt from piling up.

There are a million more of these Action items we could bring up but your primary goal should be to focus on taking some Action. Don’t let yourself be caught up in the vicious cycle of Motion, instead identify what you want to improve with your personal finances, then take Action.

If you can’t figure out how to make forward progress, don’t give up! It’s perfectly fine to move between Action and Motion, provided you return to taking Action. And, if you still can’t find a way to take Action, call us. We would be happy to design a plan to focus on your continued improvement!

Disclosure:

Csenge Advisory Group, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, asset class, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.