What is financial planning?

When you really take the time to boil it down, it’s simply nothing more than a comprehensive planning session around some topic. For some that might be counting the days until you stop working and retire. For others, it’s understanding how to bring on a business partner, divide their company equity, and keep growing their business.

But the most crucial part of your planning is not when you do it, but how often. Similar to working out, you don’t get fit by lifting weights one day. It’s the series of continued workouts that accumulate and compound into the long-term success of your fitness.

The same is true with how we approach our financial planning. Add in the frequency with which we evaluate our results and success is much easier to obtain.

Focus On The Road Ahead

When training for a marathon, you will never hear the advice to look behind you or look stare at the ground. Instead, our goal with running is to focus ahead, on where we are going, and take our attention off the individual steps. The race will evolve over time and our goal is to instead “put the reps in” and stay consistent.

Financial planning is also an evolving process. Just when you think your roadmap is complete, a curveball is thrown that changes our direction. I came across an amazing visual from Tim Urban that really does a great job visualizing our future. Any part of your life can be analyzed with this image. And to put it shortly, life is what you make of it.

Too many of us spend our time focusing on the past.

- We focus on how much money we should have saved…

- We focus on which stocks we should have bought…

- We focus on which careers we should have gone after…

- We focus on all the time we wasted over our life…

But the most important part is what’s ahead. What you do with your life today will directly impact your future self. Taking some action today puts you on the trajectory for where you want to be in life. Just like with a marathon, the miles in our rearview are irrelevant. The past is now closed and we can only focus on taking the right steps for our future.

Real Financial Planning

So what in the world does this have to do with financial planning? The reality is, most financial plans become irrelevant if not done correctly. We need to more accurately match our financial planning process to how we actually live our lives.

The concept of financial planning is dramatically shifting in my mind. Rather than doing these robust, annual, comprehensive financial projections, we are shifting to more real-time “spot checks” on our financial health. Instead of looking at every component of your finances once, we are tightening the bolts in various areas of your finances in real-time.

Your financial picture is a living breathing organism. Like the heart, it’s constantly pumping new data through your personal balance sheet. Income comes in, dividends get paid, expenses go out, and more importantly, your outlook shifts. I rarely see clients that have the exact same financial plans year over year. Instead, they begin to focus on where they stand today and begin to drift down some future path. Like the chart above, all of the paths closed to us are irrelevant, and instead, the paths open to us are now crucial.

The more we “spot check” our finances, the more financial data we retain, and the more financial data we have, the easier it is to identify “loose bolts” in our financial picture.

Your financial planning becomes a more nimble, agile, and tactical process. We can now react to a change in a direction much quicker than we could before. As you evaluate different paths ahead, the more accurately we have been putting in the reps with our planning over time, the easier it is to make a change in direction.

- Thinking of a job change?

- Thinking about relocating?

- Thinking about purchasing a business?

- Thinking about retirement?

- Thinking about a legacy for your family?

You don’t need to have a full robust financial plan to solve any of these topics. Instead, continuously working on the various aspects of your financial life, while keeping great records, will cut the time down in evaluating any financial decision.

This is how real financial planning is implemented. By monitoring our financial health more regularly, as we would our physical health, we better map out how we sit today. When we know how we sit today, making decisions for tomorrow becomes so much easier. Our planning should shift from static to dynamic to adapt to a more dynamic world.

Implementation

Putting all of this together is not as hard as you think. As technology has advanced, it has now never been easier to start planning. What was once a cumbersome process of organizing all of your finances, tax forms, account statements, and everything else have changed to online platforms built to help keep you organized.

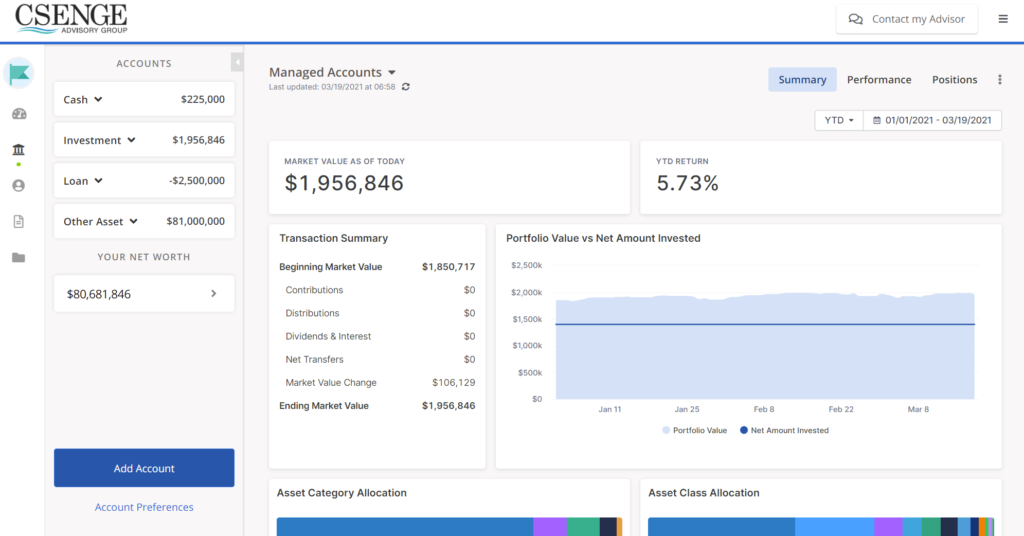

For our own client experience, we have revamped our offering to allow clients the ability to see all their assets in a single location. This helps them stay organized while allowing us to provide even more accurate and timely planning inputs. Advisors, like myself, are here to monitor as many inputs as possible which help identify when shifts are needed. The more accurate we can collectively keep your household finances, the better we can evaluate paths on the road ahead for you.

The final note would be to remember that life will never go according to plan. Whether it’s your health, your career, your family, or whatever, life is uncontrollable.

I tell clients all the time “life throws curveballs”. You won’t know what they are, or when they are pitched, but how you approach them is crucial. If we continuously spot-check our finances and track our progress, then as one path closes and a few new ones open, we will make evaluating these forks in the road a breeze.

Disclosure:

Csenge Advisory Group, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, asset class, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.