Peter Lynch is famously quoted saying “buy what you know”. A simple statement to help investors find a path forward among the confusion of the investing world. In the 1970’s, when Peter Lynch ran Fidelity’s Magellan fund, investing was a platform for the ultra rich and highly educated. Today, anyone with a smartphone can trade complex options with about 3 clicks.

Investing has never been easier…

Yet, investing has never been more confusing…

A few years back, I wrote a piece about Information Overload. The idea was that as we enter the information age, we are completely overwhelmed on every possible topic. Whether trying to set our fantasy football team or finding a good recipe for dinner, the available information is absolutely insane. Some of it creates a sort of confirmation bias, while the other makes us immediately regret our decisions.

This year, as soon as my fantasy football draft was completed, the Yahoo Sports algorithm immediately scored my picks and gave me a B-. All that time researching my team, and Yahoo comes along and tells you “your a B- student”. Did I pick the wrong players?!? It even says “That’s not bad! It’s not great, either”

Since March, I probably get 5-10 messages a week from some client asking about company they know or admire. This is following the Peter Lynch approach of buying what you know, however, the confusion is shocking. Enter Tesla..

Tesla is a remarkable company. Revolutionizing the automotive and electrical industry with a focus on saving the planet. Elon Musk, the visionary founder, is adored by investors everywhere. He is quoted in the past as saying Tesla is his experiment to force sustainability change across the globe. Simply put, the only way to get the automotive industry to focus on saving our planet is to beat them at their game. This approach has now been replicated by other industries. Take Impossible Foods, which also aims to attack a large global issue, CO2 emissions, with the introduction of meat replacements.

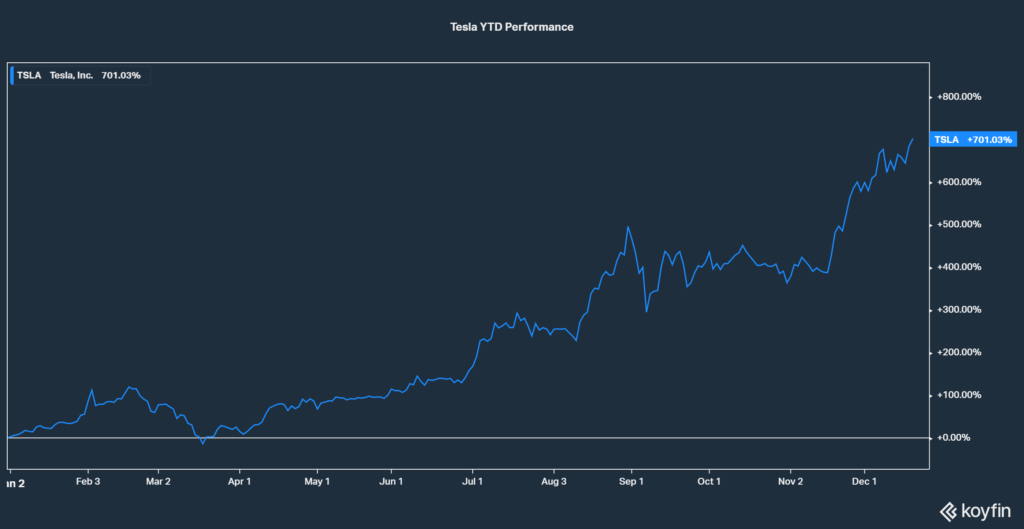

Now, Tesla makes fantastic cars, amazing software, and has extremely innovative take on roofing but a great company and a great stock are two different things. Over the past year, Tesla is up an astonishing 700%+. A large portion of that run up came shortly after its breakout in May. This is not a bad thing, seeing a company stock soar, but you have to realize how much perfection is being priced into the security at any one time.

At the start of June, Tesla broke out of its trading range and seemed to “rocket” higher, almost every day. From $150 to $200, to $300 to $400+ per share, the stock kept climbing. (split adjusted)

Now, for stocks to move, they need some sort catalyst. Some surprise earnings news or some new product, but really the only major news was almost from another planet…

To close out May, SpaceX has the first successful private launch of astronauts in history. No longer were major governments the only organizations launching astronauts into space, now private capital is funding our future expansion into outer space.

A huge accomplishment for humanity but unfortunately, a lot of investors confuse news about SpaceX and news about Tesla. Take, for example, this Barron’s article from June:

SpaceX Makes Tesla Stock Look Even Better. Just Ask Wall Street.

The success for SpaceX was seen as a success for Tesla, even though they are separate companies. Tesla is still a remarkable company but how much of its move is attributable to automotive and power innovations and how much is attributable to colonizing Mars? How much of the success is simply Elon himself? And, how much of his personal success is baked into an auto and energy company?

Now, for a Wall Street firm to extrapolate success across businesses is one thing. But for the average “mom and pop” investors, the lines are so blurry that any misinformation just fuels the confusion. This is where the “buy what you know” theory flies out of control.

Was Peter Lynch saying buy companies we know of?

Or are he saying buy companies we know well?

Misinformation is something investors face daily and I would expect no slowdown anytime soon. I guess you could look at it through the same lens as fake news. How can you really be sure the news you are reading is going to impact an investment you are looking to make or already own?

All investment decisions you make should be vetted, just as well as you would prepare for a home purchase. However, the majority of investors buy a investment off advice found in comment sections on Reddit, Yahoo Message Boards, or Twitter. Decisions that should be informed and should take weeks to evaluate are instead decided within seconds.

I would recommend investors begin with Peter Lynch’s advice and research companies we already know. This is a great starting position to understand investing more generally. Instead of blinding throwing money at companies, start to learn more about the businesses you already know. You will then evolve from knowing companies to knowing companies well and identify many new avenues for investment.

Disclosure:

Csenge Advisory Group, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, asset class, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.