For most investors, retirement planning consists of a few simple tasks:

- Stuff some money in the 401k…

- Then, stuff some money into an IRA…

- Then sit back and let compound interest do its thing.

For a large majority of investors, that’s enough. Life isn’t about having your entire net worth wrapped up in retirement accounts. You need to live a little and spend some on life as it happens.

But, if you are one of the lucky few that has the ability to put even more away for your future, there are some amazing vehicles to help keep money in your pocket, keep things invested, and set your future self up for success.

Let’s take a peek at Health Savings Accounts.

Health Savings Accounts were established in 2003 as a means to help individuals “self-fund” their health care expenses. Rather than paying large premiums each paycheck, you would instead opt into a high-deductible health plan and save additional funds in these accounts to cover future health expenses.

This makes a ton of sense, especially for younger, healthier individuals. Pay less now for your medical insurance, and stockpile as much money as you can for health expenses in the future.

Now, I don’t want the rest of this article to go over the concept of health insurance and medical expenses. You can read plenty about HSA accounts with a quick Google search. But what if we look at a Health Savings Account as another arrow in the quiver of your retirement equation. What if, instead of saving money for medical expenses, we just save money and collect the tax benefits?

First, let’s look at the tax treatment of HSA’s…

Health Savings Accounts are a unique animal. Unique in the way that they are triple tax-free.

You receive a tax deduction for the amount you contribute (up to the IRS yearly cap)

They grow tax-free while money accumulates inside the account

Distributions are tax-free (provided they are used for medical expenses)

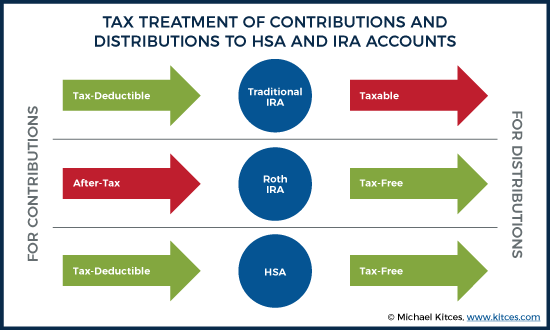

Let’s compare this to IRA and Roth IRA accounts.

The big difference between an IRA and HSA is you are receiving both a tax-deduction upfront and a tax-free distribution on the back end. It’s like the HSA is a combination of a Traditional IRA and Roth IRA all in one nice wrapper. But to receive those benefits, you have to follow ALL of the IRS rules!

Now, all of this sounds too good Jack, what I am missing. The answer is probably you skimmed over bullet 3 above.

“…provided they are used for medical expenses.”

Herein lies the biggest area investors must focus on when it comes to HSA’s. What we use the HSA dollars for, directly determines the tax liability.

If we use HSA money to cover medical expenses, we are in the clear. We used the HSA account for its exact purpose. Our contributions were tax-deductible, the growth was tax-free, and our distribution becomes tax-free as well.

However, if we use the money for anything else, we will have to settle up with the IRS and pay tax. For those visual learners, here’s a simple overview.

Let’s say you spent HSA money on a new TV. The next thing we next need to determine how old you are. Your age determines how the IRS taxes the distribution from your HSA.

- Under 65 years old = taxable as income + 20% penalty

- Over 65 years old = taxable as income (no penalty)

If we stop focusing on spending HSA dollars solely on medical expenses, the utility of the account broadens:

If you use the money for health expenses, the HSA almost acts more like a Roth IRA.

If you use the money for non-health-related expenses, the HSA acts more like a Traditional IRA.

So, herein lies the true power of an HSA. I really wish the Government would expand contribution limits, clearly define how it works, and allow investors to use the account without a high deductible plan. In a single account, we can save for our future medical expenses, our future retirement expenses, and receive extremely favorable tax treatment on both contributions and distributions.

Couple with this, the fact that most major banks will now allow you to invest your HSA contributions! As with all retirement and investment accounts, we always aim for compound interest to grow our wealth. Imagine having an additional investing source, with immense health care benefits, that can do that same thing!

Disclosure:

Csenge Advisory Group, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, asset class, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.