2020 is one for the record books. Not just the annual record books, but more of a year that will be in focus for investors, researchers, academics, and so many more for decades to come.

The past year will be in our history books forever.

If I were to call you in January of last year and say the following things, you would think I lost my mind:

- The world will be plagued by disease

- Everyone will begin wearing masks in public

- People will finally learn to wash their hands

- Economies across the globe will completely shutdown

- We will fight to find toilet paper

- The Tampa Bay Lightning will win the Stanley Cup

- The Buccaneers will recruit Tom Brady and make the playoffs

- The stock market will fall over 30%

- Then, the stock market will reach all-time highs

- Bitcoin will explode higher

It almost seems crazy writing this but I guess we can finally say the quote we have been using for years:

“Hindsight is 2020”

But, after years like 2020, it’s ideal to look back at what worked and what didn’t. At the end of the day, we are all working on something. Whether retirement, college for our kids, or growing our business. 2020 is just one of the many years between where we started saving and where we want to be.

Yes, it may have been a truly strange year, but we got through it. The question is, how did your portfolio get through it? Were you able to maintain your strategy through ALL of 2020?

The curveball that was 2020 really shook investor portfolios. In the chart above, you can see the max decline a specific asset class saw during the first 3 months of the year.

- Small-cap stocks fell over 40% in the first quarter

- Most international stocks fell over 30% in this same time

- US Real Estate fell almost 40%

- Oil fell nearly 70%

The first three months of 2020 were a gut punch to investors. You really needed to have your portfolio and mindset in the right places to weather the storm.

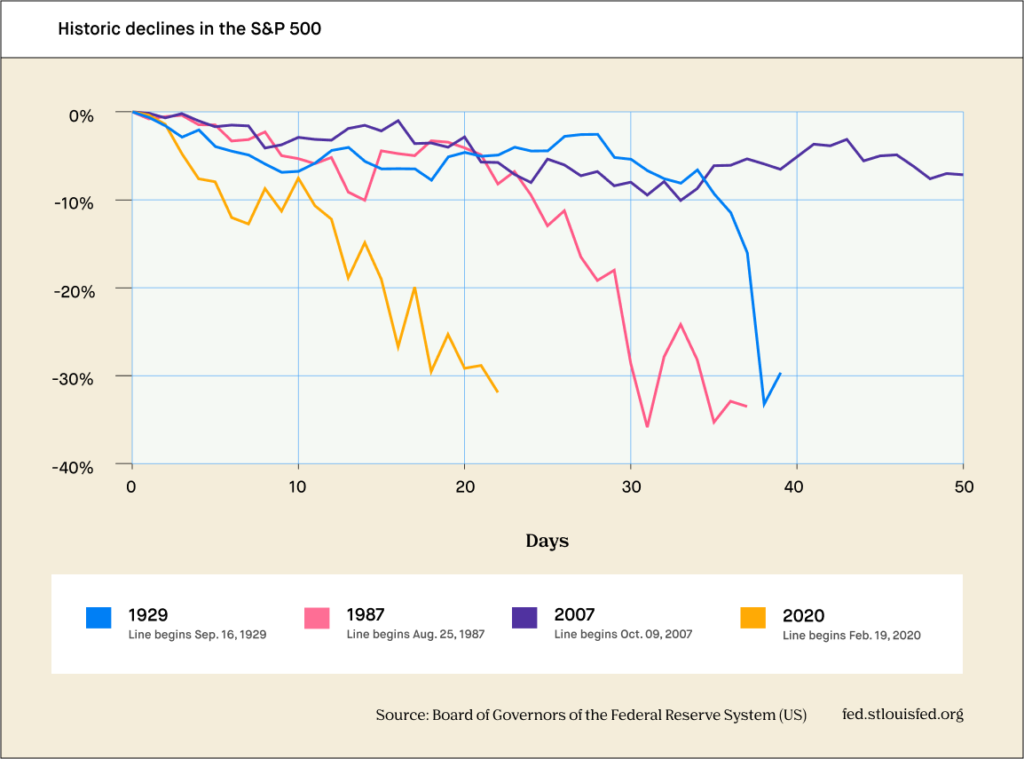

Most investors we spoke with were almost in a sort of panic during this time period; reasonably so. This wasn’t a long, drawn-out decline. Instead, it was a series of intensely sharp drops and pops the entire month of March.

When I think of market volatility like this, I almost compare it to the struggles of excelling at a specific hobby you might enjoy. For me, that’s surfing.

All surfers enjoy days with calm “glassy” conditions, with perfect waves rolling towards the beach. But in reality, that’s not how surfing is. You will from time-to-time get amazing conditions but most of the time you have to train and excel through a variety of conditions. Those conditions could be choppy waters, high winds, rough currents, or maybe even challenging weather. But the goal remains the same, we want to surf!

You don’t always get days like this (photo below), so you have to be prepared to work through worse conditions. You “play the hand that dealt” but approach it with whatever resources you need.

The same is true with your investments. To achieve investment returns over time, you have to deal with the volatility of the underlying assets. Sure, it would be nice to have consistent, low-volatility years with great investment gains but that’s not how life works. The occasional volatility is part of the process. It’s how well we stick with our process that makes our plans work in the long-term.

What seems easy in some years may also be unbearable in other years.

For example, in 2017, you had almost no work to do. You simply sat back, bought any stock index, and watched the market do its thing. Then, in 2018, the market kept crashing throughout the year. This same strategy would have created losses in your portfolio months later. Investor temperament when going from a high-performance year to a low-performance year is crucial.

There’s a great quote from Robert Allen, an author and investment advisor from the ’80s and ’90s:

I can’t name one myself. Most wealthy individuals have one of two things in common:

- They consistently invested in themselves, or

- They consistently invested in their business

Both of these can lead to outcomes of wild success but they both require taking risks.

If you are a business owner, you may take risks by investing in your business. Instead of owning stocks and bonds, your investments could be inventory, personnel, or software. These “investments” compound the rate that your business grows and in-turn grow your wealth. The risk is that you face could be too much inventory or not enough software for whatever environment you are operating in.

While, if you an individual investor, we use stocks, bonds, real estate, and other investments to gain the same effect. The goal is not to simply stockpile money into our bank but instead invest that money in areas that will compound our wealth forward. I think if you approach your investments like a business, you can start to approach volatility a bit differently.

Financial markets, like any business, will have their ups and downs over time. It’s up to you as an investor to determine how to work through these periods.

During times of stress, most businesses don’t close up shop. They don’t cash in their inventory and tools and quit. Instead, they pivot, adapt, and reinvest according to their market conditions. Maybe the market favors reinvestment in marketing or new personnel. But these decisions are made with a focus to further grow the business.

This too is exactly how individual investors should approach investing. Instead of going to cash, going all to stocks, or making some rash decision. Think through your investment portfolio almost like a business. Maybe the answer to market volatility is rebalancing the portfolio. Or, doubling down on investments we are confident in for the years ahead.

But, just like surfing, you don’t quit when the conditions are rough. Instead, you might change your surfboard out or the location of where you paddle out.

So this is how we plan for 2021.

If we look back at the asset class performance chart from earlier. To see the great returns of the second half of 2020 you had to stomach some significant volatility early in the year. Like the feeling in your stomach when your plummet towards the ground on a rollercoaster, everyone’s investments created an identical feeling when we started crashing in March. It’s impossible to predict what might cause financial stress like this in years ahead but we can start to craft how we act during that next event.

Maybe your investments dropped too fast and kept you up at night. Well, US corporate bonds didn’t even dip last year. Maybe you should rebalance your investments a bit more conservatively.

Or, maybe your investments didn’t recover as quickly as you might have hoped. In this case, we should be looking at which stocks you own across the board.

The answer to what we do should always be never quit. Instead, think like a business. Review the market, review your portfolio, and reposition in areas best positioned for growth.

Read our last post here: https://csenge.com/investing/small-steps/

Disclosure:

Csenge Advisory Group, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, asset class, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.